$20 Bonus + 25% OFF CLAIM OFFER

Place Your Order With Us Today And Go Stress-Free

Revenue Management Scenario of Jazdin Hotel Evaluation

The Jazdin hotel operates in a Competitive market with four other hotels nearby. This competition duly impacts operating capacity, profitability of Jazdin. This report created for the quarterly meeting with the hotel owners, assesses the revenue performance of the Jazdin Hotel using key performance indicators (KPIs) like occupancy, Average Daily Rate (ADR) and revenue per available room (RevPAR).

The analysis is based on the latest STR Report for 2023, comparing the hotel’s performance to the previous year and its competitors. This report will give a detailed overview of the Hotel’s current market position and performance.

An analysis of the percentage change in Occupancy, ADR and RevPAR against last year data.

The occupancy rate is a crucial indicator of how well a hotel is doing. It shows the percentage of rooms that are sold during a specific time frame. This rate indicates the hotel’s success in attracting and keeping guests.

Occupancy change percentage is calculated by subtracting last year’s occupancy from current year’s occupancy, diving by last year’s occupancy and then multiplied by 100

The rise in visitors at Jazdin Hotel indicates that their success despite challenging market conditions and strong competition.

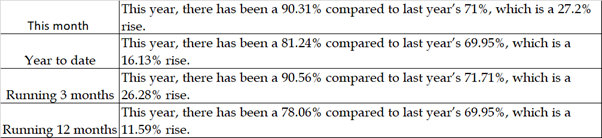

This report indicates that the occupancy rate at Jazdin Hotel has risen during various time frames.

ADR is an important measure that calculates the average revenue earned per occupied room. It helps to assess the hotel’s room pricing and revenue management effectiveness.

ADR change percentage is calculated by subtracting last year’s ADR from current year’s ADR, diving by last year’s ADR and then multiplied by 100

The decrease in ADR is a result of the competition and changes in pricing strategy to attract more guests.

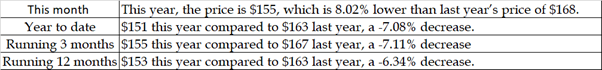

The ADR of Jazdin Hotel has dropped which suggest difficulties in maintaining control over pricing. Further, it indicates that there is high competition in the market which has caused price war in the market. In order to survive and attain high occupancy, pricing discount has been considered as ideal method.

RevPAR is a useful measure that considers both occupancy and ADR to evaluate how well a hotel is making money from its rooms.

Percentage change in RevPAR = (current year RevPAR – last year RevPAR)/last year RevPAR * 100

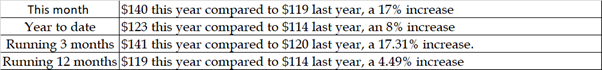

The rise in RevPAR shows how higher occupancy rates are making a positive difference, even with the decrease in ADR.

Even though the ADR has gone down, Jazdin Hotel’s RevPAR has improved.

An evaluation of the hotel’s performance against its competitors using Occupancy, ADR and RevPAR as points of comparison:

This month – Jazdin Hotel saw a substantial increase in occupancy by 27.02% as compared to last year whereas its competitors experienced an increase of 17.29% which is lower than that of Jazdin Hotel.

Year to Date – The hotel experienced an increase of 16.13% in its occupancy, whereas the competitors saw an increase of 13.22% in its occupancy.

Running 3 months - The hotel saw an increase of 26.28% in its occupancy, whereas the competitors saw an increase of only 15.37% in its occupancy.

Running 12 months - The Jazdin Hotel experienced an increase of 11.59% in its occupancy, whereas the competitors saw an increase of 9.18% in its occupancy.

Based on this parameter, a view may be taken that Jazdin has performed better and has been able to attract higher customers.

This month – Jazdin Hotel saw a substantial decrease in its ADR by 8.02% as compared to last year whereas its competitors experienced a decrease of 17.29%.

Year to Date – ADR for the hotel fell by 7.08%, whereas for competitors by 5.97%.

Running 3 months - ADR for the hotel decrease by 7.11%, whereas for competitors by 3.17%.

Running 12 months - ADR for the hotel fell by 6.34%. Similarly, ADR for competitors fell by 6.38%.

Based on this parameter, it may be inferred that hotel has provided higher discount as compared to competitors.

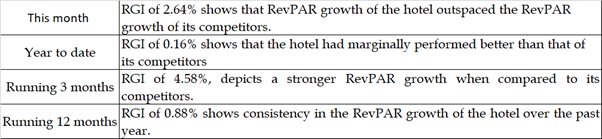

This month – Jazdin Hotel saw a substantial increase of 17% in its RevPAR compared to its competitors which experienced an increase of 13.99%.

Year to Date – RevPAR for the hotel rose by 8%, whereas competitors experience an increase of 7.83%.

Running 3 months - RevPAR for the hotel increase by 17.31%, whereas for competitors it is 12.17%.

Running 12 months - RevPAR for the hotel rose by 4.49%, while the competitors experience an increase of 3.58%.

Based on this parameter, it may be inferred that hotel has been able to achieve higher occupancy which has caused RevPAR to increase.

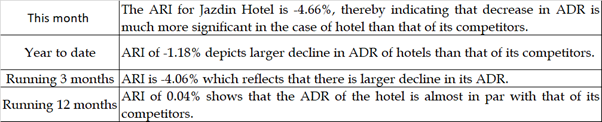

This month – The MPI for Jazdin Hotel is 8.45%, thereby indicating a strong performance when compared to its competitors.

Year to Date – MPI of 2.57% depicts growth in hotel’s occupancy which outspaced its competitors.

Running 3 months - MPI of 9.45% shows supremacy in its occupancy performance.

Running 12 months - MPI of 2.21% shows its consistency in leading the occupancy when compared to its competitors.

The Jazdin Hotel has improved its performance in occupancy and RevPAR as compared to last year, hence outperforming competitor consistently. Despite this, the hotel has struggled with ADR, experiencing more significant declines than rivals.

This indicates that although the hotel is attracting large number of guests, there might be possibilities to enhance revenue strategies to effectively handle ADR and optimize overall revenue.

This thorough analysis sets the basis for strategic discussions during the upcoming quarterly meeting, ensuring ongoing growth and competitiveness in the market.

Are you confident that you will achieve the grade? Our best Expert will help you improve your grade

Order Now